Coronavirus (COVID-19) and Business Interruption Insurance

26/03/2020by Doug Kelley26/03/2020Coronavirus (COVID-19) and Business Interruption InsuranceBluedrop Services

With Coronavirus sweeping the nation and affecting both families and businesses, the government recently enforced stricter measures to prevent the spread of the virus by closing non-essential businesses and advising staff to work from home if possible. These measures are to stay in place for a minimum of 3 weeks.

These are very unsettling times, and we appreciate that there are many questions about what your business insurance and business interruption insurance covers, and if it protects you from closures requested by the government.

We have put together the following information to help give you a better understanding of what is and isn't included in business insurance and business interruption insurance cover.

Coronavirus and the current state of the market

(last updated 25/03/2020)

Because Coronavirus is so new, there are very few business insurance policies that cover it. Since the outbreak of SARs in 2003, some extension policies include compulsory closure caused by any 'notifiable infectious diseases', many of these insurers list the specific diseases they cover. However, most of these policies do not include new and emerging diseases like Coronavirus.

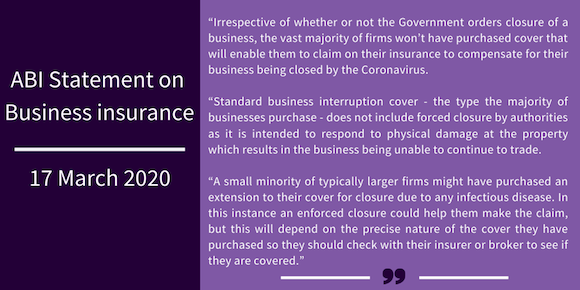

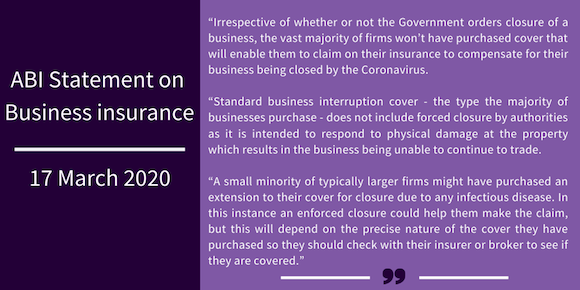

on the 17th of March, the Association of British Insurers released this statement:

What does business interruption insurance cover?

Business interruption is an additional item of standard business insurance, it covers against a wide range of day to day risks including damages caused by fires, floods, theft or accidents involving employees and equipment breaking down. This insurance covers you for any increase in running costs and if there's a shortfall in profits to a limit set out in the policy.

Does standard business interruption insurance cover businesses that aren't able to operate due to Coronavirus?

It is unlikely that business interruption insurance covers global pandemics such as Coronavirus. Some businesses purchase an extension to their interruption insurance to protect them from specific risks. However, only a small number of businesses choose to buy a form of cover that includes closure due to an infectious disease.

Does a 'notifiable disease' extension to business interruption insurance cover my business for Coronavirus?

Most 'notifiable disease' extensions specify what disease they cover by listing the name of the disease in the policy. It is unlikely that Coronavirus will be specified in the policy as it is a new disease, this means the cover will not apply. However, if the 'notifiable disease' extension is more general and doesn't specify what disease it covers, your insurance may cover Coronavirus. You will need to check your policy with your provider to find out what is and isn't covered.

Are there any other extensions to business interruption that may provide cover for Coronavirus?

Some policies include a 'non-damage denial of access' extension to business interruption insurance policy. Businesses that are forced or told to close by a local authority figure or denied access because the area is cordoned off may be able to claim under this extension.

This type of extension cover is rare and not generally included in standard business interruption policies. You will need to contact your provider for more information.

We understand that this is a worrying time, if your business insurance policy does not cover Coronavirus, the government has issued a range of different solutions that can provide financial help for your business, you can read more about this here.

We will continue to update this page as and when the Government makes any new announcements affecting businesses. If you require more information or would like advice on your business insurance, please contact one of our insurance brokers who will be able to assist you.

Return to guide menuWant to find out more about Bluedrop's Business Insurance?

Industry updates, helpful guides and useful information from our experts.

SubscribeBook your FREE Insurance Review for expert advice tailored to your business

Request Review Privacy and Cookie Policy

Privacy and Cookie Policy  Terms of Business

Terms of Business  Making a Complaint

Making a ComplaintIf you are unhappy with our service we have a complaints procedure, details of which are available on request by contacting us on 01489 222 897 or alternatively by clicking Make a Complaint above.

You may be able to refer a complaint to the Financial Ombudsman Service (FOS) if you are unhappy with how we deal with your complaint. The FOS website is www.financial-ombudsman.org.uk

Bluedrop Services (NW) Limited Company No: 7287668 Registered Office: Unit 4 Flanders Road, 1st Floor West Wing, Royal London Park, Hedge End SO30 2LG.

Bluedrop Services (NW) Limited is authorised and regulated by the Financial Conduct Authority. Registration No. 530244. You can check our registration by contacting the FCA on 0800 111 6768 or by visiting www.fca.org.uk/register.